Where travel agents earn, learn and save!

News / Europeans can't wait to get back to the US says Skyscanner

After being unable to visit the United States since March 2020, European travellers are eager to get back to some of their favourite destinations, particularly New York

In November’s first travel insights report, Skyscanner is sharing some especially interesting search and booking trends alongside the latest global traveller sentiment data.

Europeans can't wait to get back to the US

After being unable to visit the United States since March 2020, European travellers are eager to get back to some of their favourite destinations, particularly New York.

The top five inbound countries to the US are:

- UK

- Spain

- Germany

- Italy

- Mexico

While booking horizons remain short, there are early signs that confidence is returning as demand also grows for the key holiday periods of Easter and summer 2022.

UK > USA

There’s high demand for travel this side of Christmas, especially in the next two weeks (after the borders have opened) and the two weeks before 25 December.

The top destinations are:

- New York

- Orlando

- Miami

- Los Angeles

- San Francisco

- Las Vegas

- Tampa

- Boston

- Chicago

- Washington DC

The top routes are:

- Heathrow to JFK, Orlando, Los Angeles and Miami

- Manchester to Orlando and JFK

- Heathrow to San Francisco, Newark, Las Vegas and Boston

- Gatwick to Orlando and Tampa

- Edinburgh to Orlando

- Average passenger numbers of 2.9 for Orlando and Tampa indicate family trips

- The average seat price to New York is £415, Orlando is £591 and Miami is £488

- 50% of travellers for July and August 2022 are looking for trips longer than two weeks

- The average share of business/premium economy (vs overall) is around 6% on Skyscanner. This rises to 8% in November and 7% in January, indicating a slight uplift in the short to mid-term

New York City is the most popular US destination for UK travellers.

Spain > USA

There’s a similar profile to the UK in terms of demand:

- Highest demand for travel w/c 29 November and w/c 13 December

- Interest in Easter and summer 2022 travel, though low in volume at the moment

- New York and Miami are taking the majority of bookings

- Top routes are Madrid to JFK and Miami, and Barcelona to JFK and Miami

Germany > USA

Again, there’s a similar demand profile to Spain and the UK:

- Highest demand for travel w/c 8 November and w/c 20 December

- There’s interest in Easter 2022 travel, though currently low in volume

- New York, Miami and Los Angeles are seeing the most demand

- The top routes are Frankfurt to JFK and Miami

Italy > USA

Italy has a similar demand profile to Germany, Spain and the UK:

- Highest demand for travel w/c 20 December and w/c 27 December

- There’s interest in Easter and summer 2022 travel, though low volumes

- New York, Miami and Los Angeles are the most popular destinations

- The top routes are Milan to JFK and Rome to JFK

Bookings to the Caribbean are on the rise

Bookings to the islands of the Caribbean are increasing from travellers around the world, with sun-seekers in Germany, the US and the UK leading the charge.

- Bookings to the winter sun destination of the Dominican Republic grew by 181% WoW following its removal from the UK red list*

- UK searches to Barbados have increased by 37% WoW

- UK searches to Antigua have increased by 35% WoW

- The top searched UK routes include Manchester to Bridgetown, Barbados (+75% WoW) and London to St John’s, Antigua (+48% WoW)

*WoW is comparing bookings from October 18-25 to October 26 - November 1.

A turtle exploring the waters around Speightstown, Barbados.

Martin Nolan, Travel Trends Expert at Skyscanner, comments:

“Winter sun holidays are typically one of the more expensive times to get away as UK travellers look to escape to warmer climes during the busy holiday season. However, this year with many airlines and travel providers offering staggering savings on travel to luxury destinations, Skyscanner has analysed the savings to be made for those wanting to head abroad for some winter sun.

"With many long-haul tourist destinations relying on travellers for their income, we expect to see similar offers and deals from travel and holiday providers across the board as they focus on boosting traveller confidence and local tourist economies.”

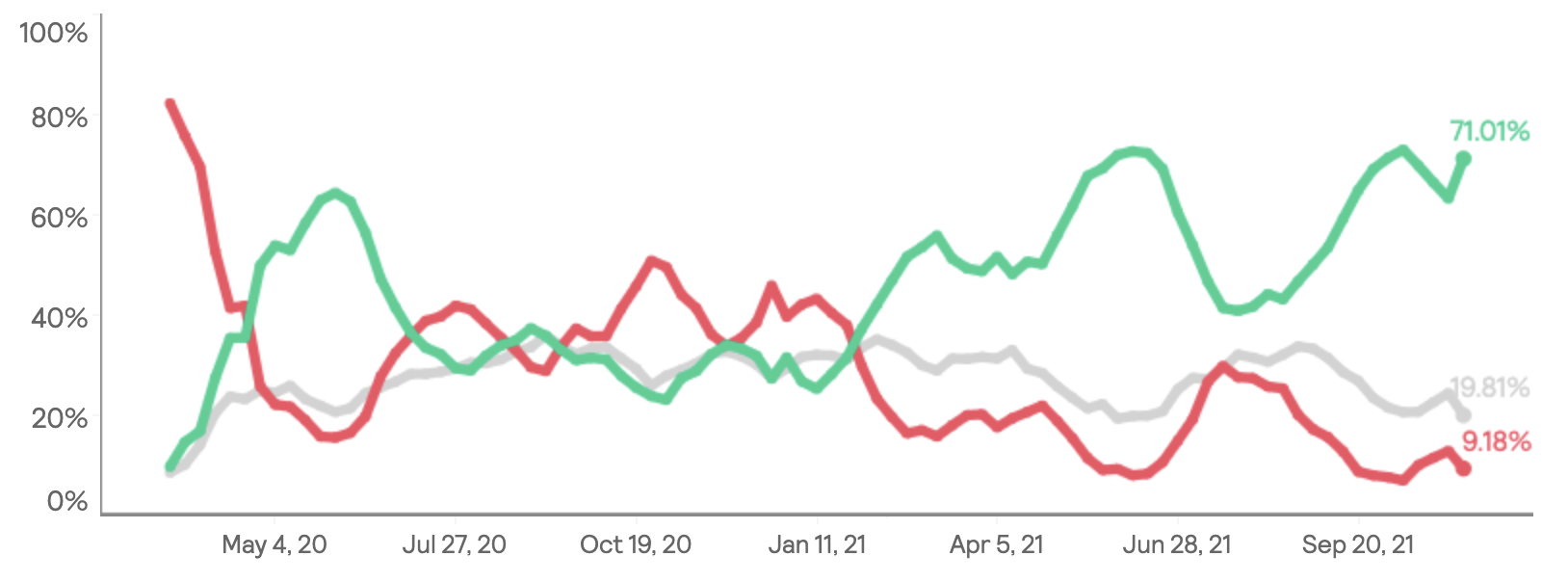

Traveller confidence grows sharply in a week

Perception of the global situation

After falling through the second half of October, traveller confidence has shot up over the first week of November – almost rising to levels seen in late June.

- 71% think it’s improving, up from 63% last week and 66% the week before

- 20% think it’s staying the same, down from 24% last week and 22% the week before

- 9% think it’s getting worse, down from 13% last week and 11% the week before

On a regional level, travellers in the Americas and Asia Pacific are the most optimistic and confident they’ve been during the entire pandemic. Confidence levels in EMEA have dropped considerably over the past few weeks.

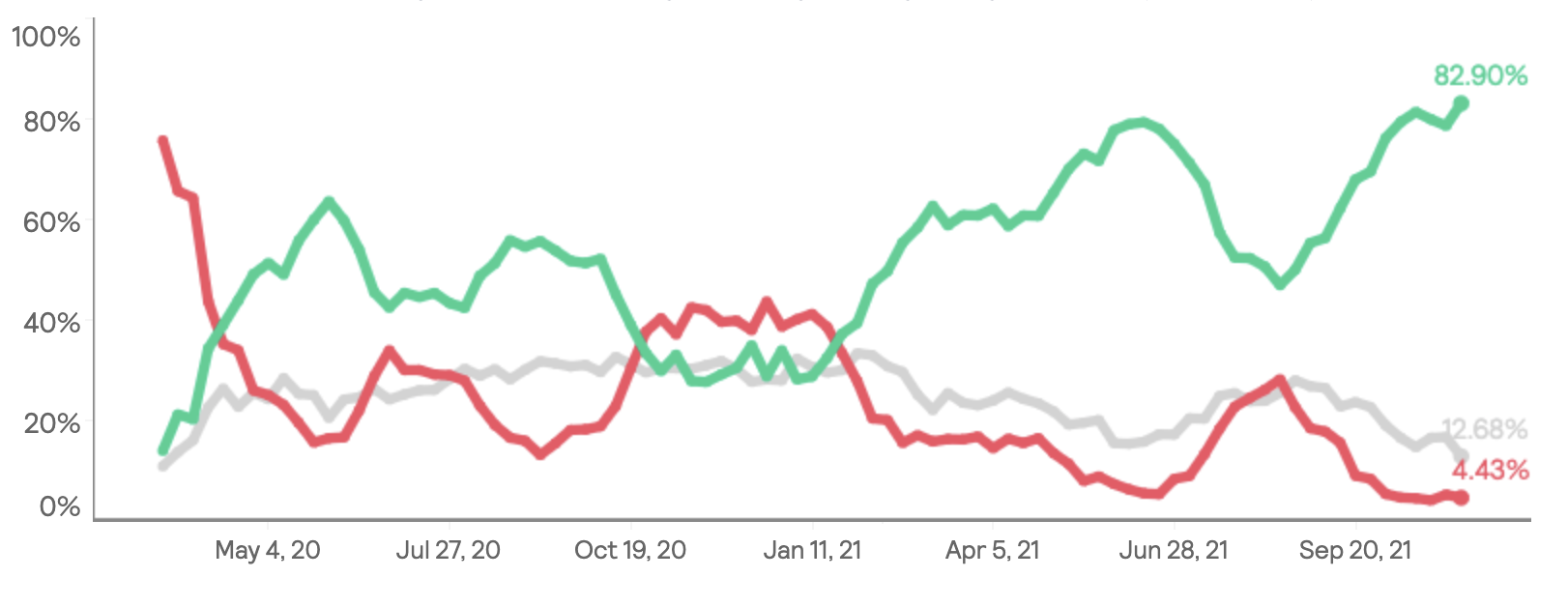

AMER

- 83% think it’s improving, up from 78% last week and 80% the week before

- 13% think it’s staying the same, down from 16% last week and the week before

- 7% think it’s getting worse, up from 5% last week and 4% the week before

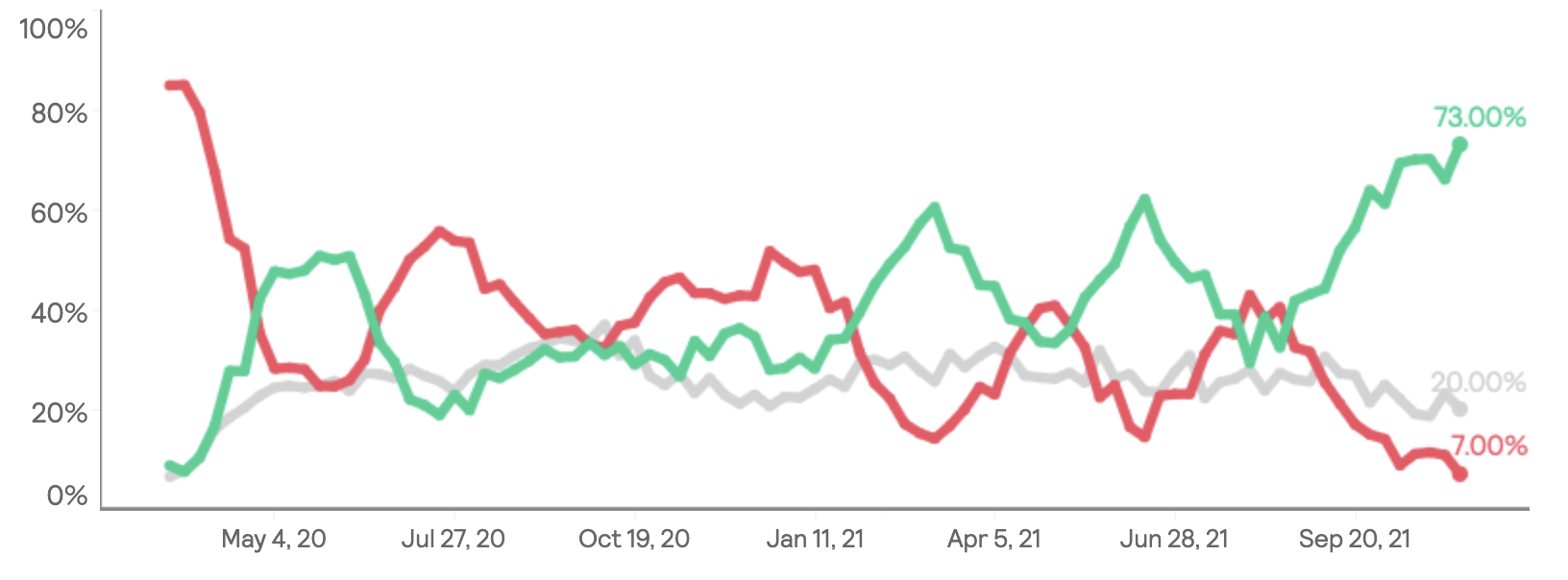

APAC

- 73% think it’s improving, up from 66% last week and 70% the week before

- 20% think it’s staying the same, down from 23% last week and up from 19% the week before

- 7% think it’s getting worse, down from 11% last week and the week before

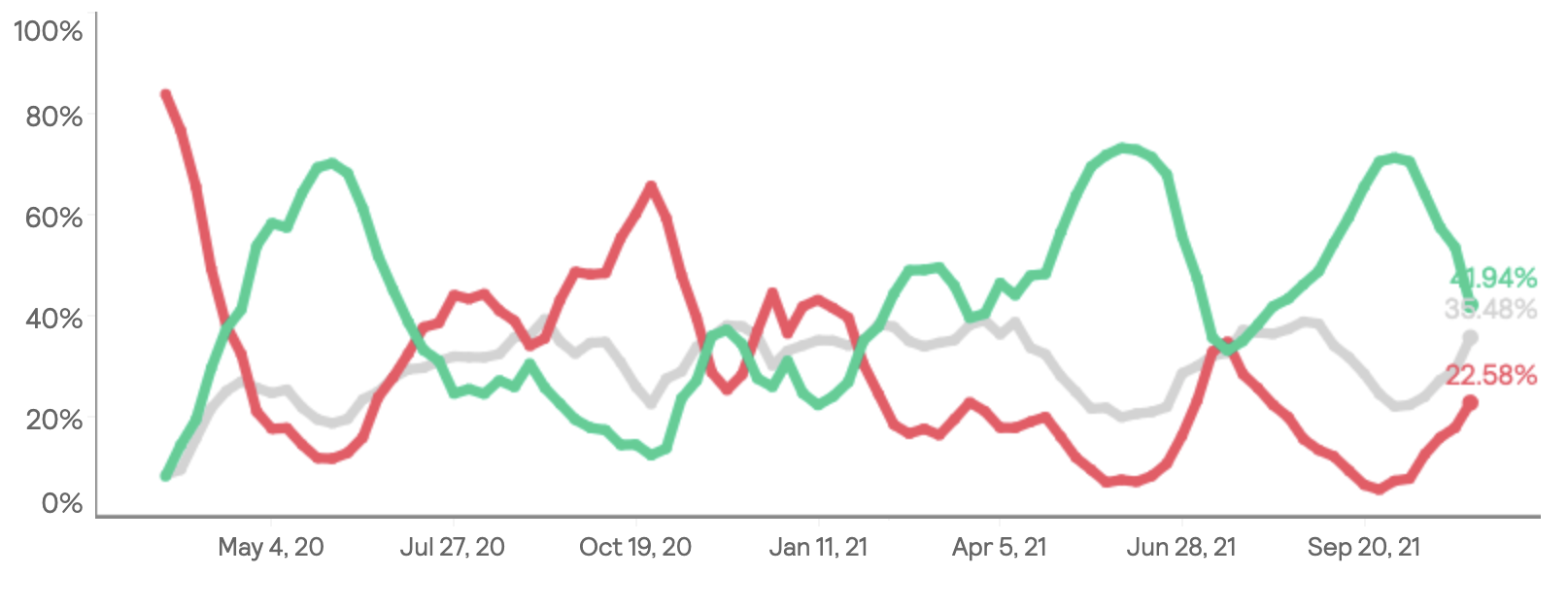

EMEA

- 42% think it’s improving, down from 53% last week and 57% the week before

- 35% think it’s staying the same, up from 29% last week and 27% the week before

- 23% think it’s getting worse, up from 18% last week and 16% the week before

A hiker near Nova Levante in the Italian Dolomites mountain range.

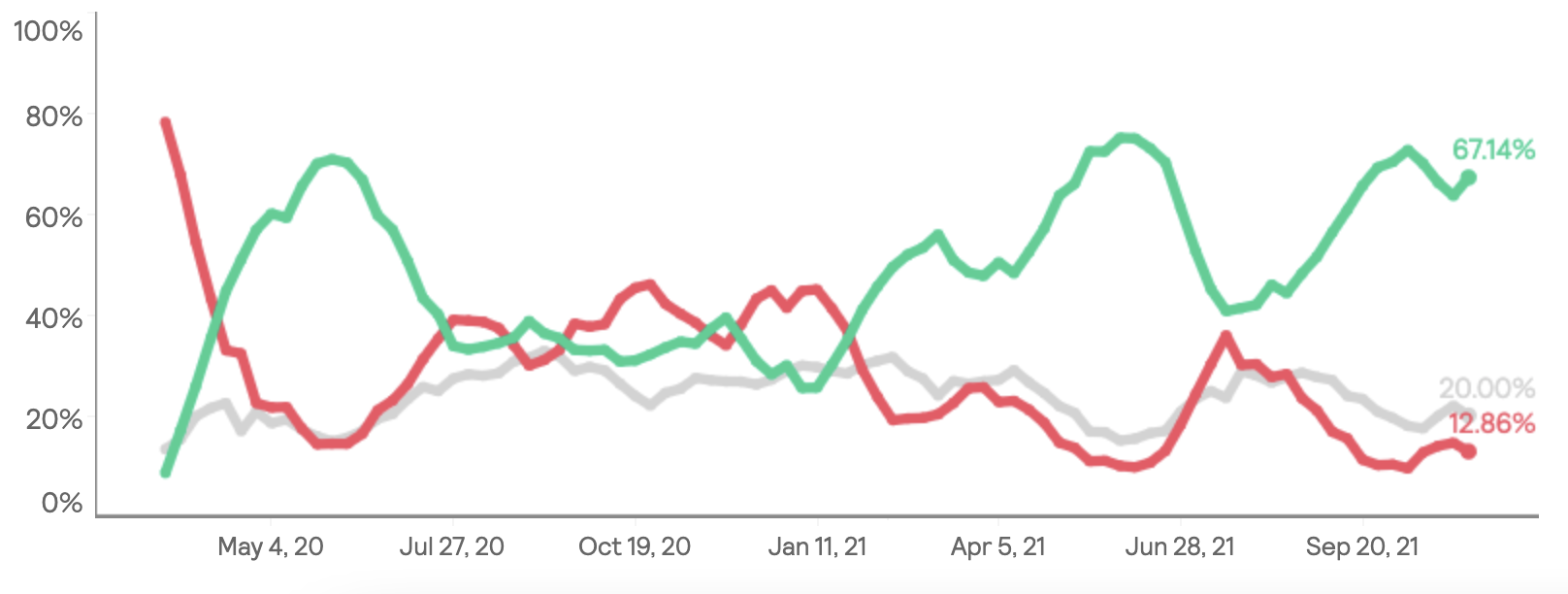

Perception of the domestic situation

The number of travellers believing their domestic situation is improving has started to rise once more, having fallen shortly from the middle of October.

- 67% think it’s improving, up from 64% last week and 66% the week before

- 20% think it’s staying the same, down from 22% last week and the same as 20% the week before

- 13% think it’s getting worse, down from 15% last week and 14% the week before

On a regional level, travellers in the Americas are the most optimistic – with their levels far higher than at any other point during the pandemic. They're followed closely by those in Asia Pacific. Travellers in EMEA are the least optimistic, with just under half of people surveyed believing the situation in their region is getting better.

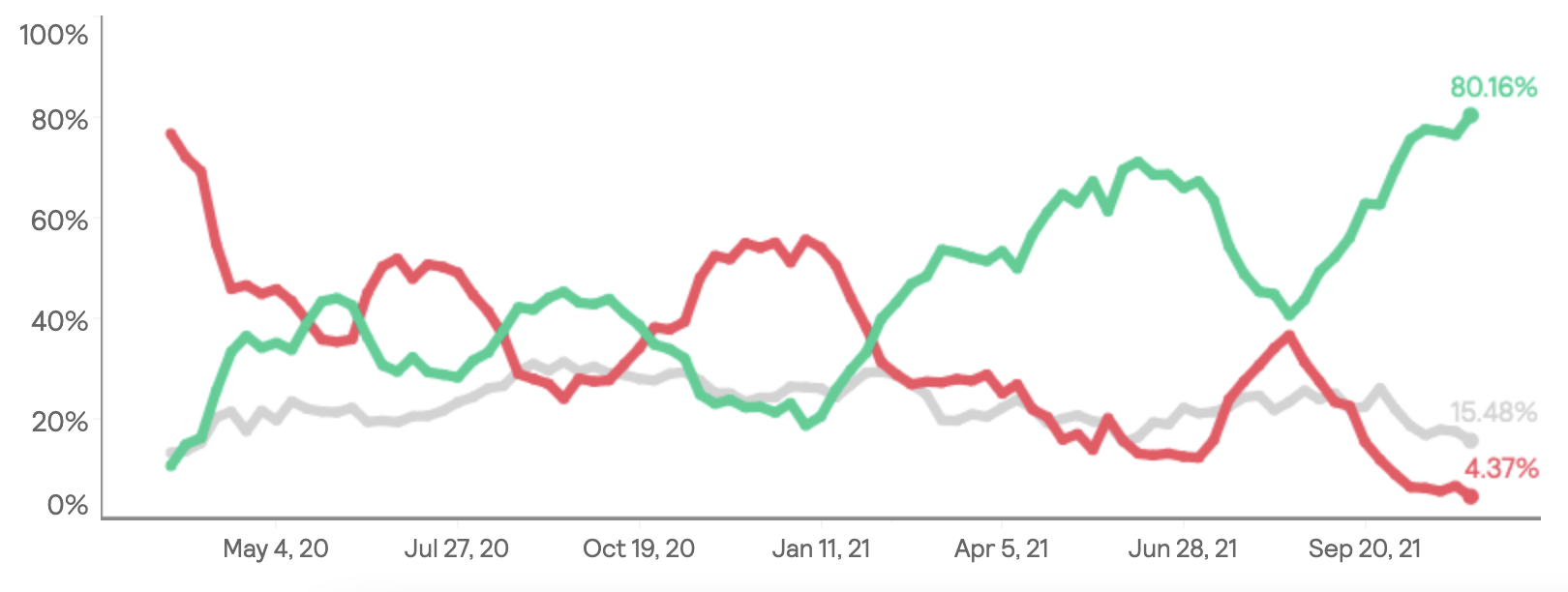

AMER

- 80% think it’s improving, up from 76% last week and 77% the week before

- 15% think it’s staying the same, down from 17% last week and 18% the week before

- 4% think it’s getting worse, down from 6% last week and 5% the week before

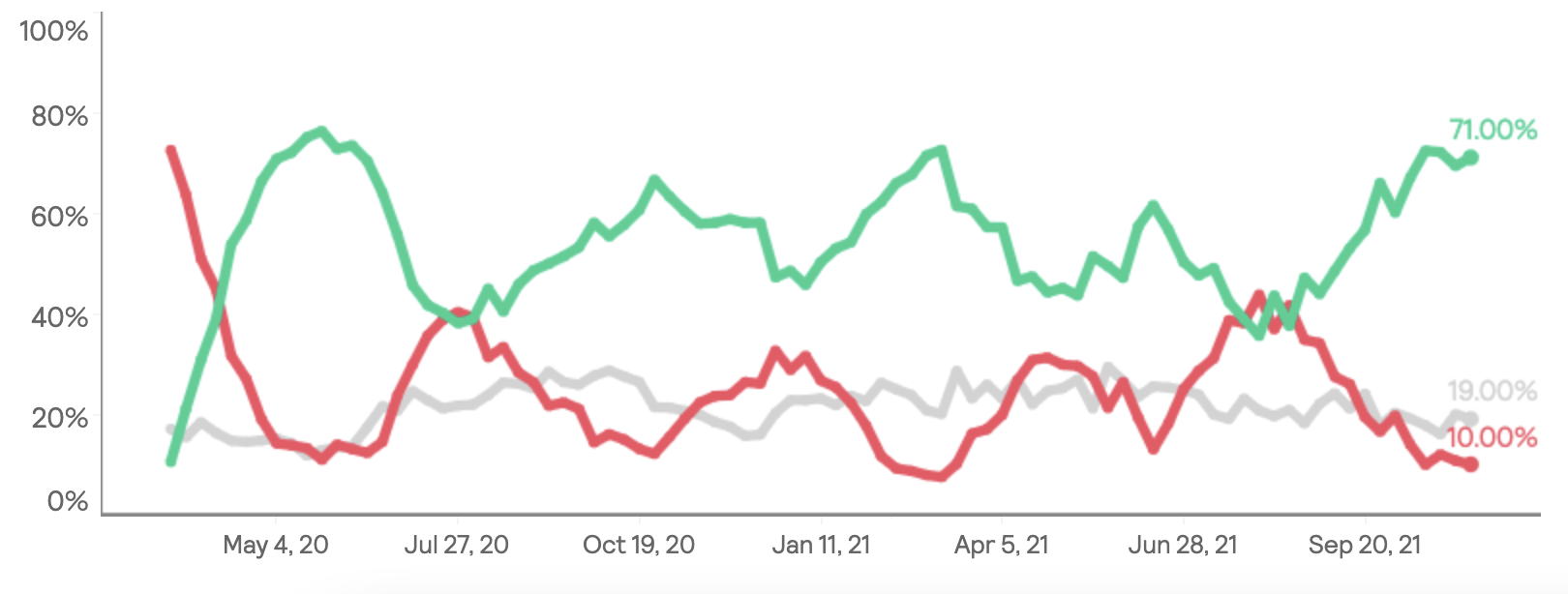

APAC

- 71% think it’s improving, up from 70% last week and down from 72% the week before

- 19% think it’s staying the same, down from 20% last week and up from 16% the week before

- 10% think it’s getting worse, down from 11% last week and 12% the week before

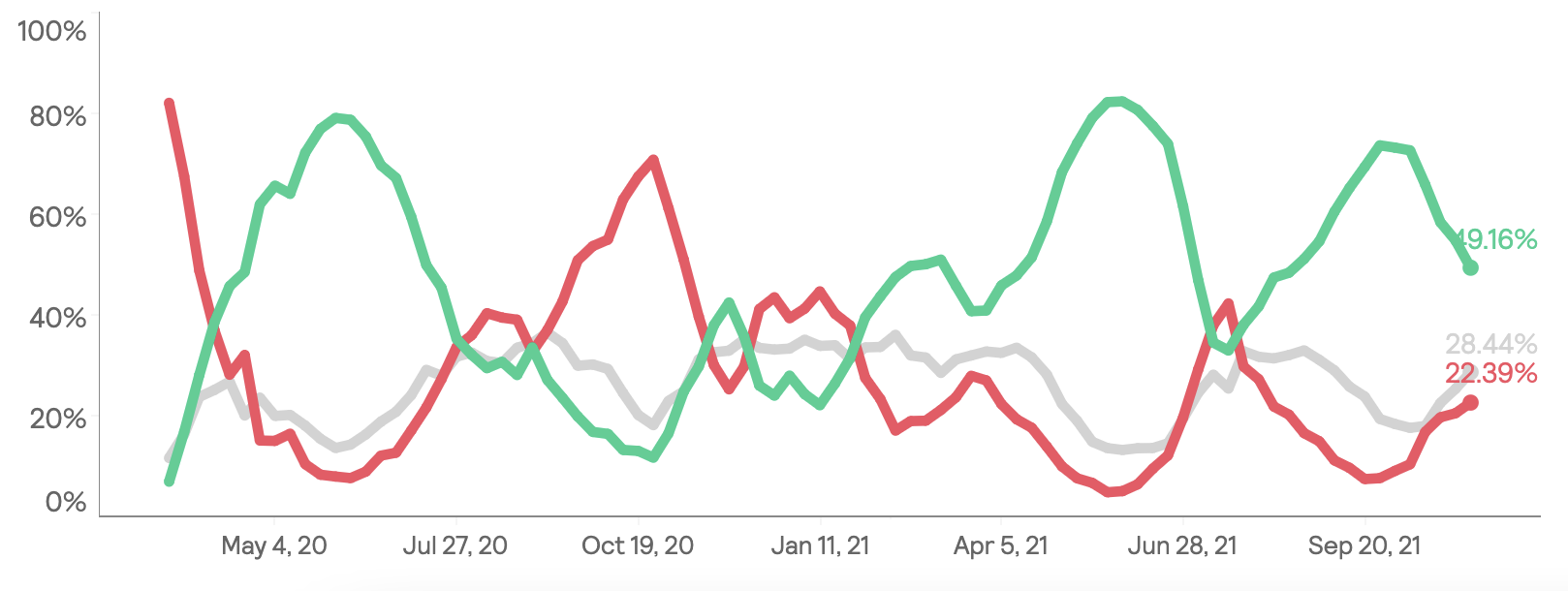

EMEA

- 49% think it’s improving, down from 55% last week and 58% the week before

- 28% think it’s staying the same, up from 25% last week and 22% the week before

- 22% think it’s getting worse, up from 20% last week and 19% the week before