Where travel agents earn, learn and save!

News / How is the Russia-Ukraine war impacting travel?

In light of the ongoing Ukraine and Russia conflict, flights searches are currently 9% below expected levels and European airfare is up 16% MoM

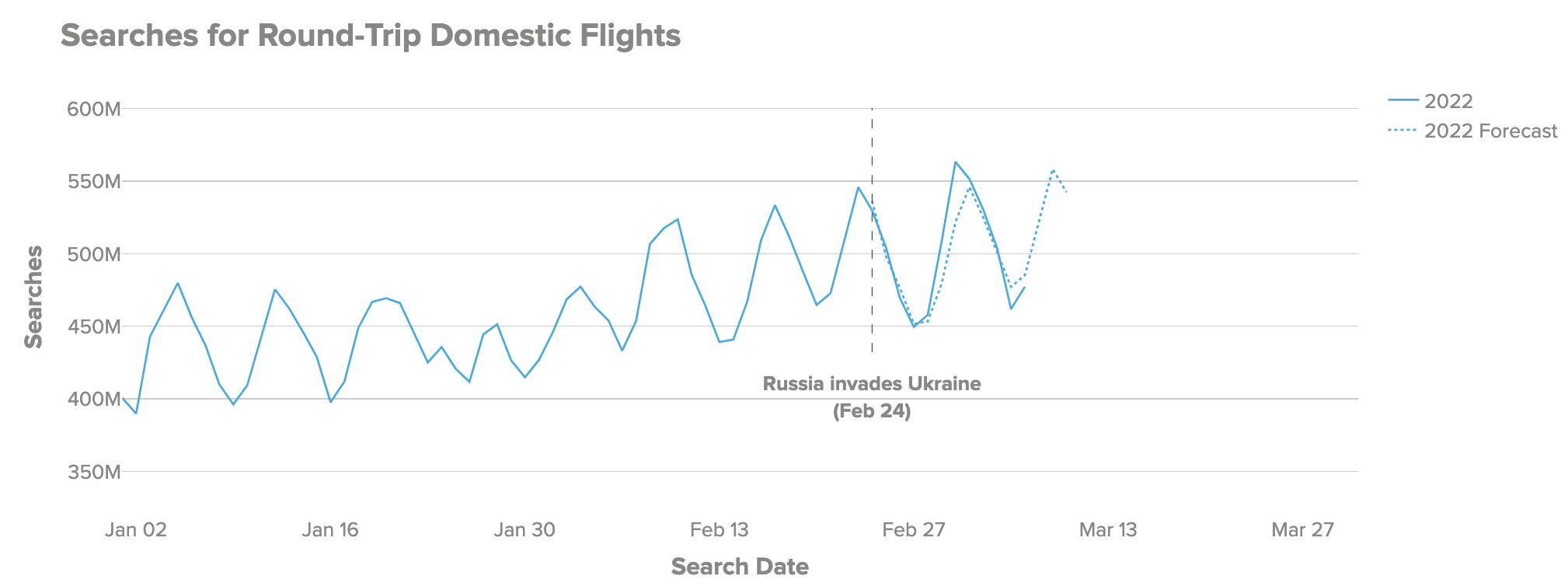

Flight Searches

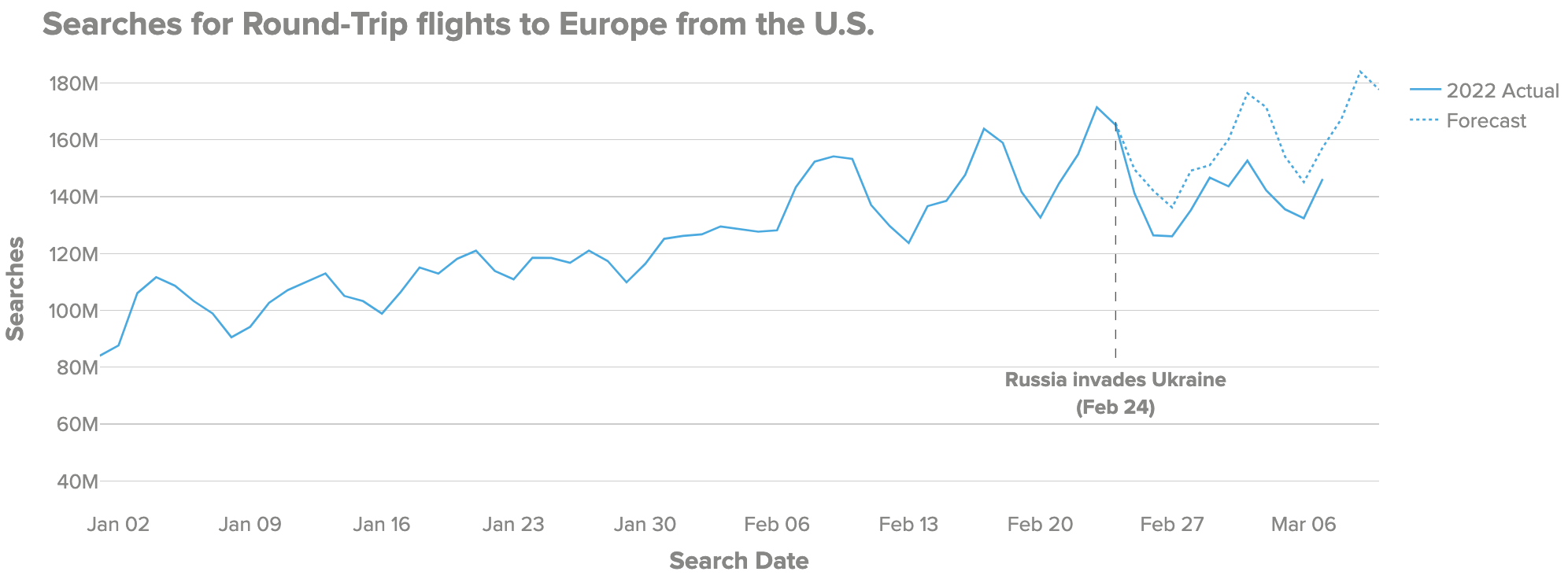

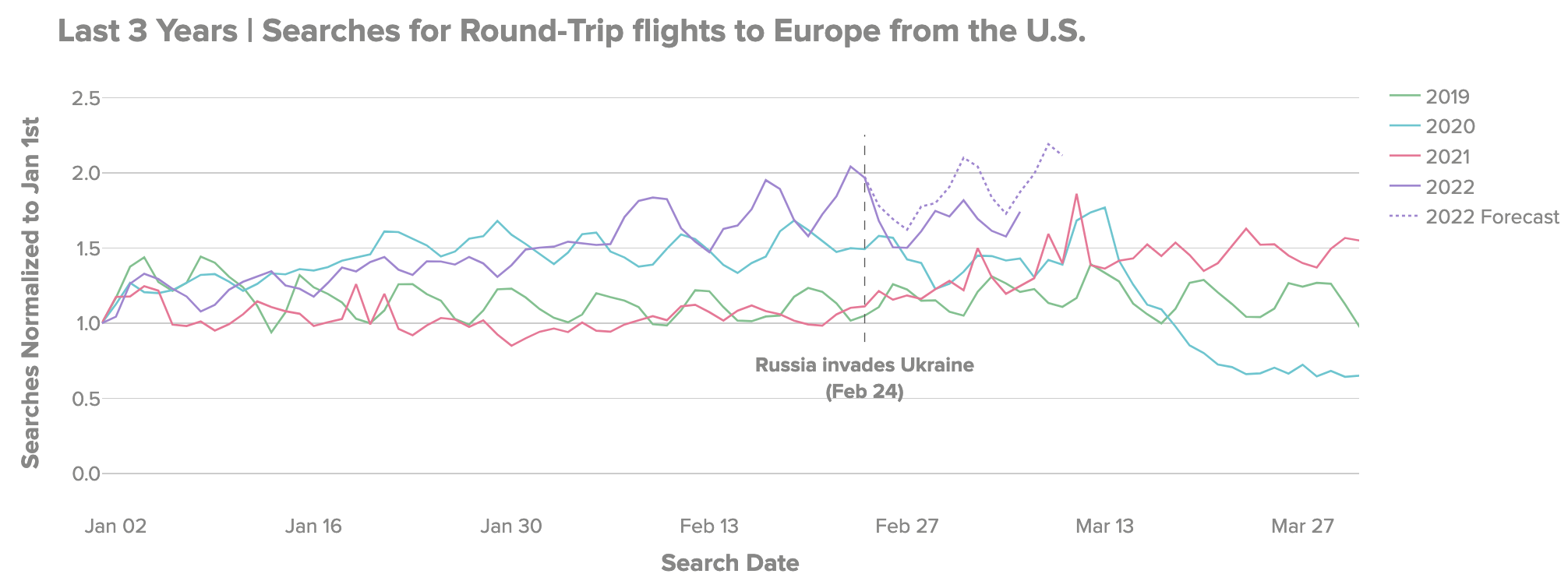

- Flight search demand from the US to Europe grew following the decline in Omicron cases, but demand began tapering towards the end of February

- Since February 24th, searches for round-trip flights from the US to Europe have been down an average of 9% below expected levels. This impact is not seasonal, and not seen for flights to other regions nor in the domestic U.S. market

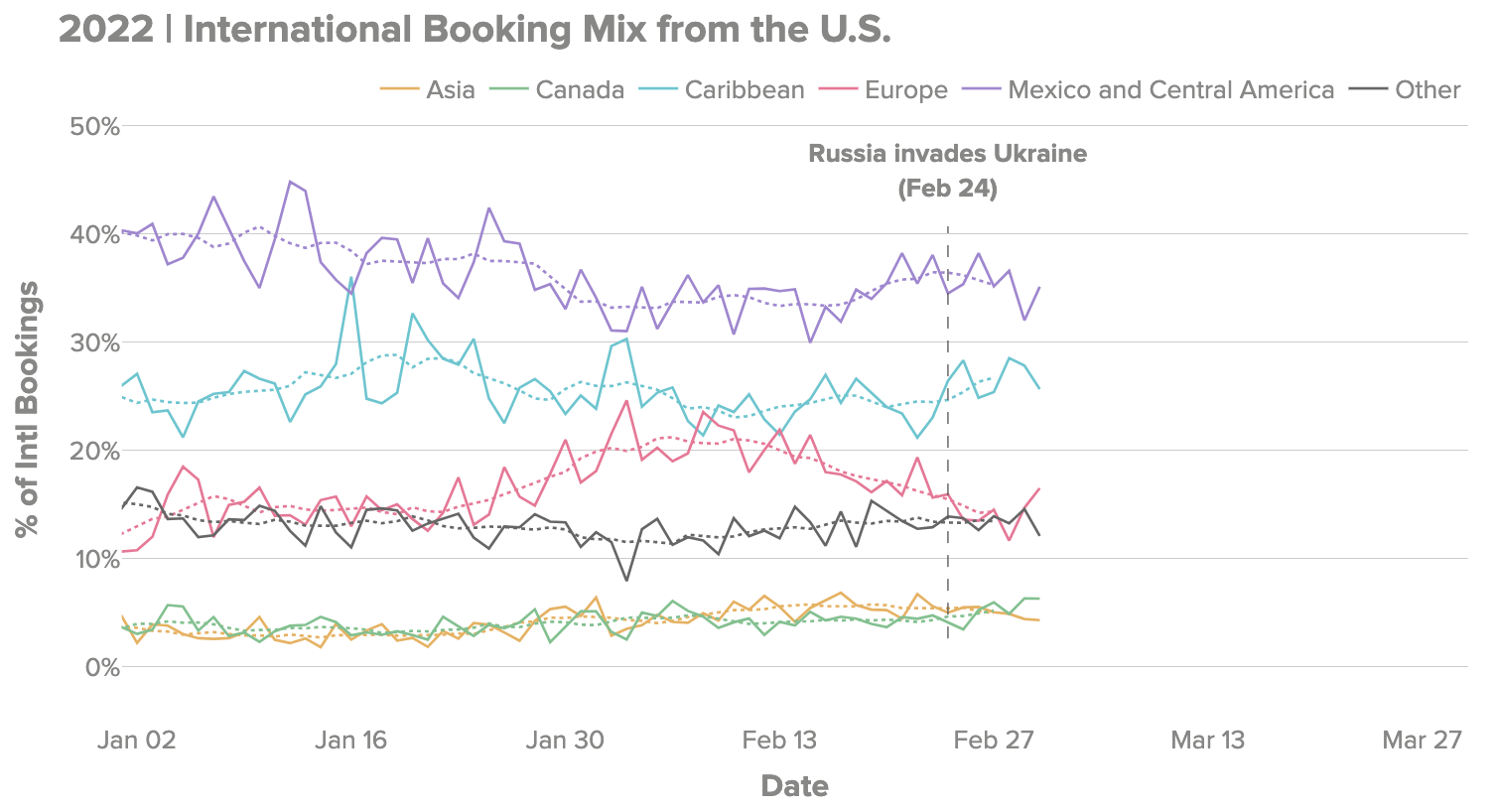

Flight Bookings

- Flight bookings from the US to Europe began surging in late January to mid-February as concerns around Omicron subsided. US to Europe flight bookings are now comparable to January levels

- The vast majority of flight bookings are still for US domestic trips, so the split between domestic and international remains unchanged

- Since February 12, Hopper has seen international bookings shift away from Europe to destinations like Mexico, Central America, and the Caribbean, which now collectively represent 61% of Hopper's international bookings

- Since February 12th, Europe has dropped from 21% to 15% of international bookings. During this time in a more normal year like 2019, Europe accounted for ~30% of international bookings

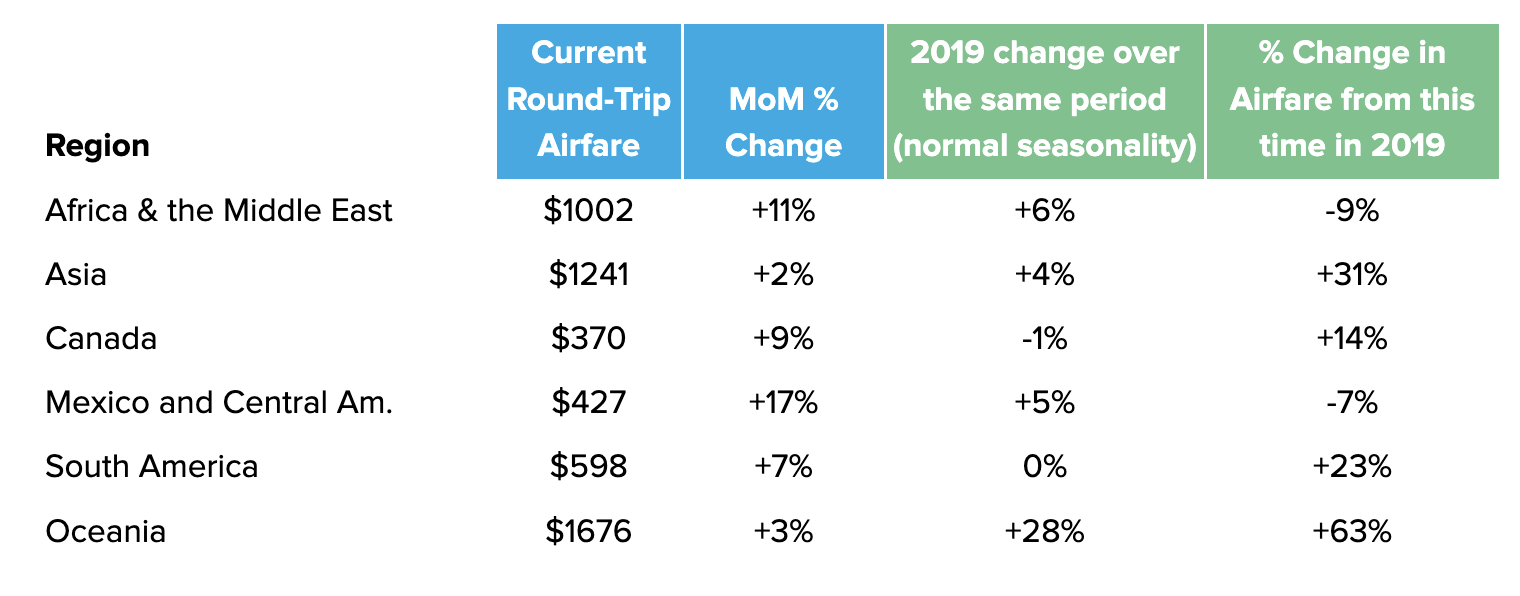

Airfare

- Airfare from the U.S. to Europe is currently (in the first week of March) $770 round-trip, a 16% increase MoM from $663 round-trip on February 12th. In 2019, airfare to Europe remained level over that same period. The increase was seen across most countries in Europe, including many in Western Europe

- Hopper is seeing airfare increases for other regions outside of Europe as well. These increases are likely primarily attributable to a combination of improving international travel demand post-Omicron and regular seasonality. While higher jet fuel prices from the Russia-Ukraine war are likely to create additional upward pressure on airfare, the impact is likely lagged and not represented in these particular increases

Jet Fuel

- U.S. Gulf Coast Kerosene-type Jet fuel reached $2.86/gallon last week, according to the EIA, continuing to hit the highest prices seen since August 2014. Since jet fuel is a product of refining crude oil, an increase in crude oil prices would result in higher jet fuel prices, which would eventually appear in higher airfare

- While the Russia-Ukraine war has no immediate impact on jet fuel prices, it could lead to higher flight prices this summer if crude oil prices continue to rise

How Is the Russia-Ukraine War Impacting Travel?

Important Dates

Flight searches to Europe

Searches for round-trip flights to Europe from the U.S. were steadily increasing as the Omicron variant wave subsided, showing strong recovering Trans-Atlantic travel demand. However, flight search demand to Europe began to taper towards the end of February, likely due to the Russia-Ukraine war. Since February 24th, searches have been down an average of 9% below expected levels. Searches for round-trip flights to Europe from the U.S. were down 9% on March 5th from forecasted levels.

Accounting for Seasonality: Hopper normalizes searches to January 1st to see how the last three years compare to 2022. Compared to a normal year like 2019, searches were increasing at a quicker rate in early February 2022 as travel demand recovered coming off the Omicron variant wave. Hopper sees searches steadily increasing from January to late February, before declining following the invasion of Ukraine. In 2019, Hopper saw searches remain level between the end of February and March, confirming that the decline is not a seasonal effect Hopper would see in a normal year. 2020 saw a decline around this time as well, but primarily due to the onset of the Covid-19 pandemic in the U.S.

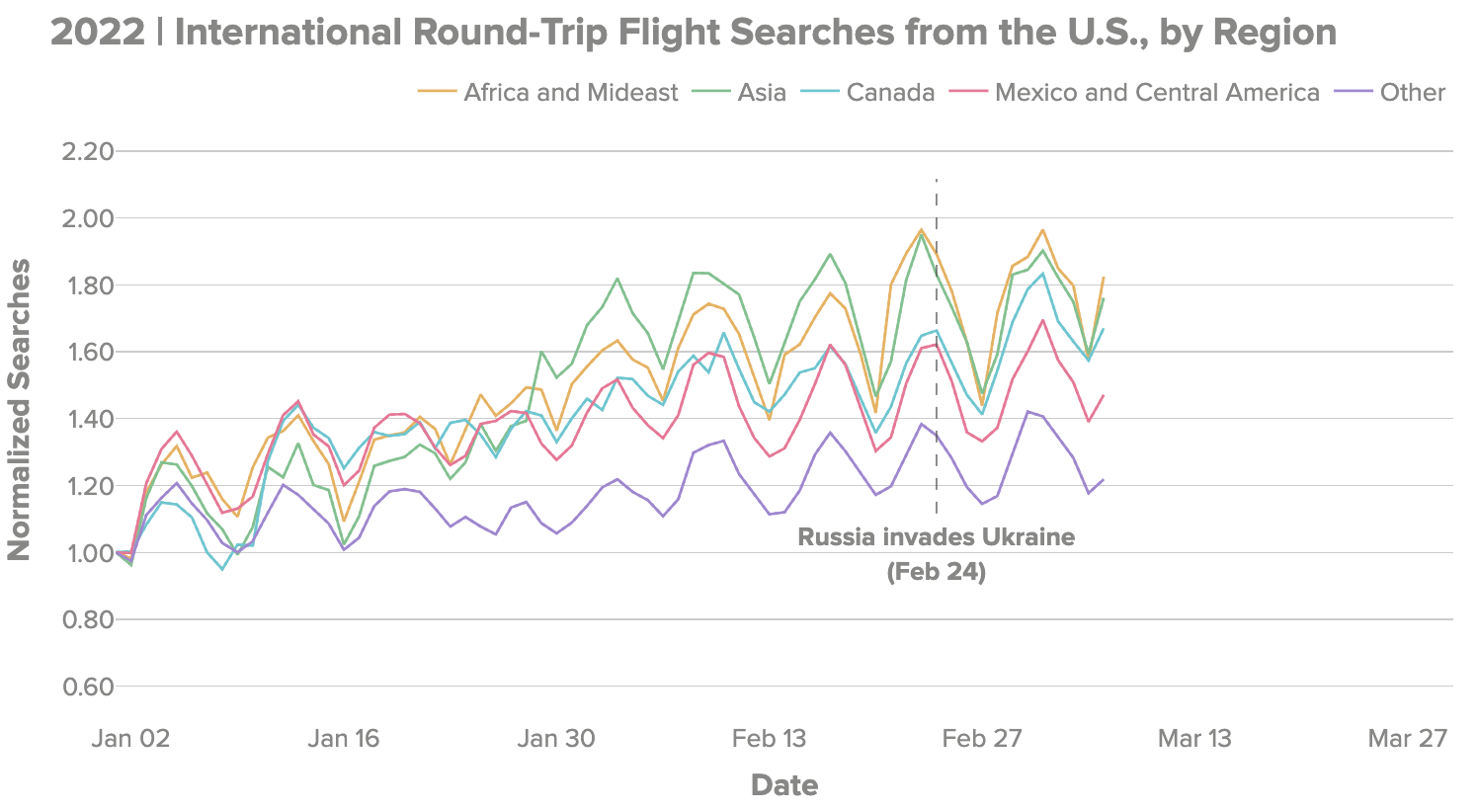

Searches to Other Regions

Domestic U.S.: Somewhat predictably, Hopper hasn't seen an impact on domestic U.S. flight searches, which have continued to trend as expected.

Other Regions: Aside from Europe, there hasn’t been a notable impact on international flight searches from the U.S. to other regions.

Bookings

Overall Booking Mix: There hasn’t been a significant shift in the percent of bookings from the U.S. for domestic/international destinations. International travel demand had not recovered since the onset of COVID-19, so the vast majority of bookings are still for domestic travel.

International Booking Mix: Looking at international bookings, the percent of international bookings to Europe increased significantly from 15% in mid-January to 21% by February 12th. February 12th was around when U.S. intel published information regarding a likely Russian invasion of Ukraine. International bookings since February 12th have shifted towards Mexico, Central America, and the Caribbean, which collectively represent 61% of international bookings. Europe now again accounts for about 15% of Hopper's international bookings. During this time in a more normal year like 2019, Europe accounted for ~30% of Hopper's international bookings.

Booking Volume: Flight bookings from the U.S. to Europe began surging in late January to mid-February as concerns around Omicron subsided. U.S. to Europe flight bookings are now comparable to January levels. International bookings from the U.S. to other regions remained relatively steady since February 12th, with no significant increases or decreases since then.

Airfares

Airfare from the U.S. to Europe is currently (in the first week of March) $770 round-trip, a 16% increase MoM from $663 round-trip on February 12th. In 2019, airfare to Europe remained level over that same period. The increase was seen across most countries in Europe, including many in Western Europe. Although, Hopper does not think this rise in fares is directly related to the Russia-Ukraine war. Hopper is seeing airfare increases for other regions outside of Europe as well.

These increases in flight prices are likely primarily attributable to a combination of improving international travel demand post-Omicron and regular seasonality. While higher jet fuel prices from the Russia-Ukraine war are likely to create additional upward pressure on airfare, the impact is likely lagged and not represented in these particular increases.

Jet Fuel

U.S. Gulf Coast Kerosene-type Jet fuel reached $2.86/gallon last week according to the EIA, continuing to hit the highest prices seen since August 2014. Since jet fuel is a product of refining crude oil, an increase in crude oil prices would see higher jet fuel prices, which would eventually appear in higher airfare.

The magnitude of the impact of jet fuel price increases on airfare is not entirely clear, and could vary significantly between carriers due to fleet fuel efficiency and to what extent they’ve hedged against price increases. In general, jet fuel accounts for about 30% of an airline’s costs, usually the second biggest expense after operational costs such as labor. This means historically a 10% rise in jet fuel cost would be associated with a 3% increase in operating expenses for the airline.

Estimating the impact of higher jet fuel prices for the Domestic U.S. Market: Since jet fuel prices have risen 30% since the start of the year (from $2.20/gallon to $2.86/gallon), Hopper has back-of-the-envelope estimate 6-9% of the 27% increase in airfare thus far in 2022 (from $236/round-trip to $300/round-trip most recently) could be attributable to higher jet fuel prices, although there is some lag between higher prices and when that shows up in airfare. (To clarify, the 6-9% of 27% should be read as two-ninths to one-third of the 27% increase could be attributable to higher jet fuel prices.) This figure is not directly tied to the Ukraine-Russia conflict, but rather represents price changes Hopper has already seen, and could give a sense of how a relative change in jet fuel price as a result of the conflict would translate to changes in airfare in the coming months.

Russian crude oil accounted for ~5% of total U.S. crude oil imports in December 2021 according to the EIA, with OPEC accounting for 12% of imports, and Canada representing one of the largest import markets with 56% of imports. Provided the U.S. enacts sanctions on Russian oil, it could look to other major suppliers such as OPEC for additional supply. However, according to AP, OPEC may stick with only modest supply increases, which is likely to prolong higher oil and gas prices.

In December 2021 (the latest data available from the EIA), jet fuel (~45m barrels) accounted for 13% of U.S. refinery net production (~339m barrels in total).

Methodology: All data is the latest available as of March 7th, 2022. “Searches” refers to data Hopper collects from several Global Distribution System partners, amounting to 25 to 30 billion airfare price quotes every day from searches happening all across the web. “Bookings” refers to bookings made on the Hopper app itself. Hopper's definition of Europe includes Ukraine, but excludes Russia. When comparing actual searches to “expected” levels, Hopper's forecast of searches is based on the prior two week trend.